How to Succeed in Startup Funding: Best Practices

No matter how good your idea is, it cannot survive without sufficient initial funding. Therefore, to enter a market of intense competition, you need to obtain the support of investors and be sure of timely financing. Unfortunately, according to cb insights, 38% of startups fail because they run out of cash and cannot raise new money. So what exactly prevents them from attracting new investments? What mistakes do they make during pre-seed and seed funding rounds? Below, well find the answers to those questions and learn how to get capital for an emerging startup.

Five of the most successful startups in the recent times

Before we get into how-tos, let’s take a look at the most successful startups that have evolved from a promising idea to a globally recognized brand. These companies entered the business with empty pockets but managed to get funding for rapid startup development.

Airbnb, an online service for accommodation, search, and short-term rental worldwide, raised initial funds after selling cereal boxes for Barack Obama and John McCain. Soon after, the company received $20k under the Y Combinator’s program. Y Combinator’s co-founder then said he was more impressed by the idea of selling cereal than he was with the Airbnb concept. Two years later, Airbnb got $7.2 million in Series A startup funding. Soon, they announced their one-millionth booking since the website launch.

Snap, which stands behind the world-known social network Snapchat, was first launched from a co-founders’ father’s living room with a minimum budget. Then, in 2013, Snapchat raised $13.5 million as Series A funding for startup businesses. Subsequent funding rounds were $80 and $50 million, respectively, in Series B and C funding.

Udacity, an e-learning platform with various courses for beginners and professionals, started from a successful Computer Science Lecture Course at Stanford University. Now it is one of the biggest educational resources worldwide. Udacity is funded by venture capital firm Charles River Ventures as well as with personal funds from the company’s founder Sebastian Thrun.

Stripe, an electronic payment system used by global marketplaces and small online stores worldwide, was initially launched using the money of its founders – the Collison brothers. Elon Musk and Peter Thiel became angel investors and Sequoia Capital provided series A company funding. A total of 40 investors invested in Stripe at different stages of the company’s development.

Spotify, a famous music streaming service, was launched on the money of founders who were already successful entrepreneurs. As the product’s popularity grew, the company attracted more investments, getting $21b million as Series A funding and $526 million as Series G.

How to get prepared for pre-seed and seed funding rounds?

Pre-seed and seed rounds are startup financing at the idea and early prototype stages. As a rule, these are relatively small amounts – from several tens to several hundred thousand dollars – allocated by startup accelerators. However, to prepare for the pre-seed and seed rounds, you need to convince investors your idea will survive in a highly competitive market. So here is what you will need to do.

Conduct industry analysis. Review industry size and growth prospects, study industry trends and profitability and highlight critical success factors. Thorough industry analysis will help you understand whether you are on the right track and what actions you need to do to achieve the desired result. For example, if you want to create a healthcare app, you should know that the most downloaded apps in this category track the state of health, while the least popular ones concentrate on nutrition services. However, to create a health app, you need to access users’ personal data. This will entail specific legal issues. So you will need to ensure you will be able to handle that in the region of your choice.

Do market research. At this stage, you need to check if there is an empty niche for your product in the selected market. For example, imagine you got an idea to create a social network for dancers. Decide which region you will be targeting, check if there are similar applications, compare them, and identify their missing features. During the research, you may want to narrow down your target audience to street dancers, or vice versa, target wider user groups, like sports youth. If you cannot or do not want to conduct market research on your own, you can contact companies that assist startups at the stage of idea verification and beyond.

Run a feasibility study. Even if you find your target audience, this does not mean that your product is guaranteed to be successful. Before investing in development, you need to evaluate the project from economic, legal, and technical points of view. Additionally, you need to agree on all the organizational issues: who, when, and how will different people be involved in product development. Also, you should correctly determine the best time for a product release.

Create a business plan. Here you need to describe your project in detail with calculations and perspectives for the next few years. The business plan should define app features, technologies in use, the development team, and the costs for each stage of development. It should also contain a marketing strategy for the product promotion and a financial plan summarizing all the basic calculations. Your business plan must answer two main questions: how much is required to launch a project, and how long will it pay off?

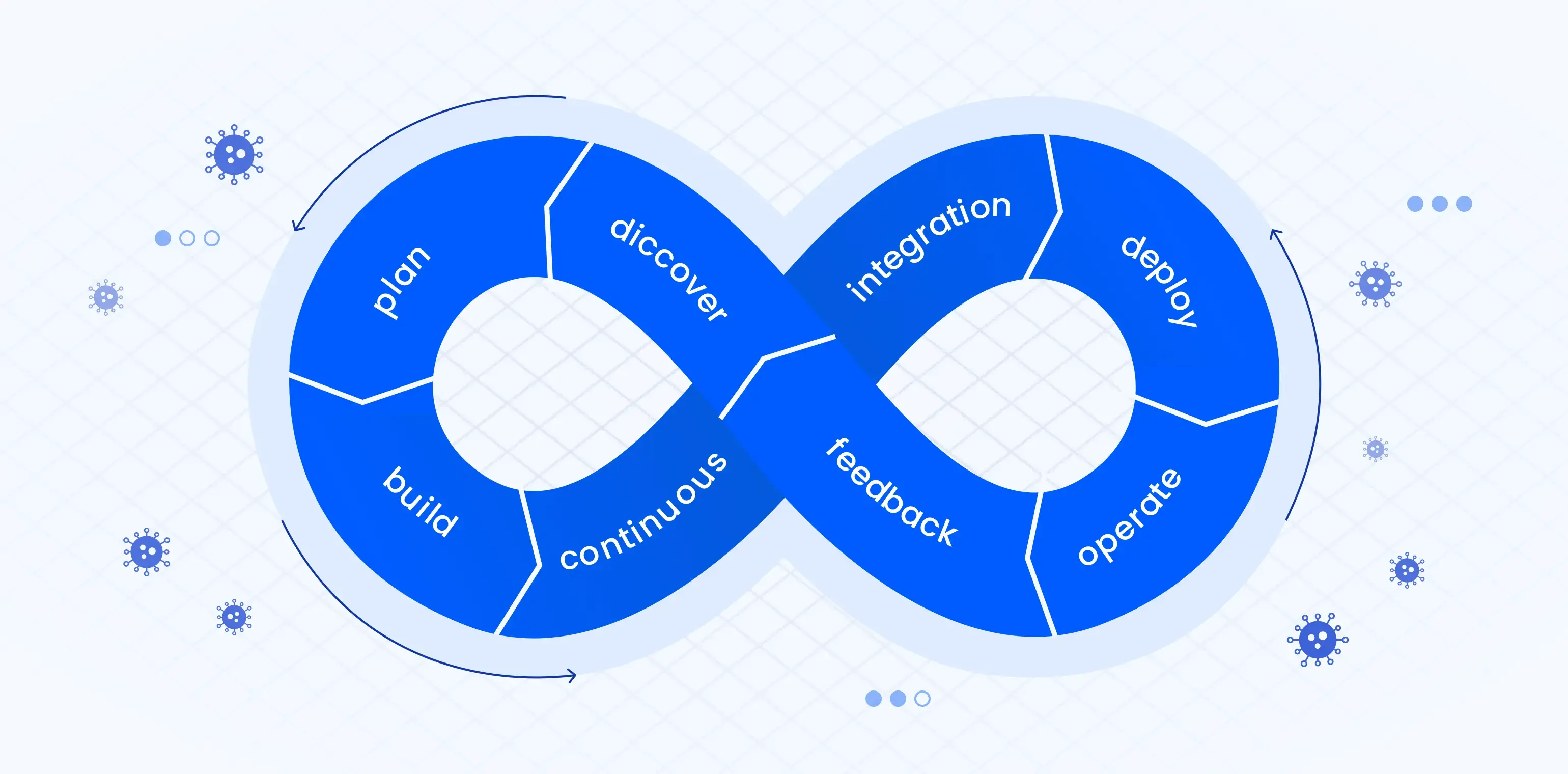

Develop a release plan. This stage plays a crucial role for entrepreneurs who want to prove their project’s validity and quickly attract investors’ funds. The release plan demonstrates the sequence of product versions and when they will be released. It also provides a detailed list of technologies in use and features that will be included in each release. In addition, the release plan provides the work breakdown structure, showing task dependencies in a hierarchical order. This way, your investors will know not only the sequence of features implementation but also the reasons for this particular order.

Three essentials to convince investors your startup will be profitable

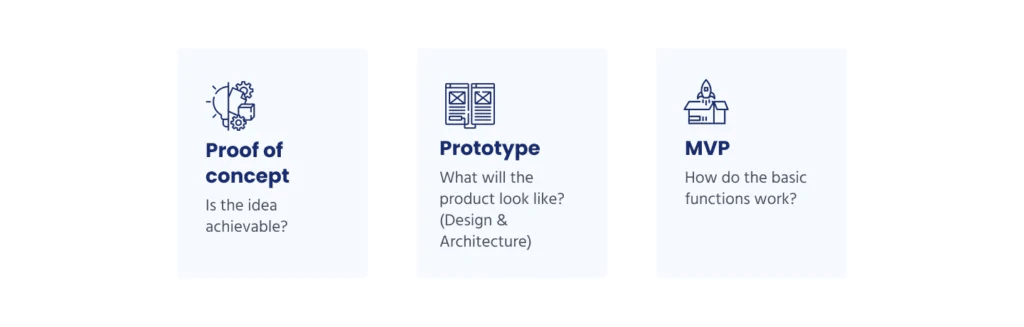

A startup must be funded at different stages of development to respond in a timely manner to growing user demands. Investors are most skeptical when you have just begun on the development path. So it is in your best interest to provide proof that you will succeed. Here are some essentials to support your idea and attract more financing options for a startup:

Proof of Concept (PoC). You have calculated the cost of implementing your product and the estimated payback period. Now it’s time to prove your concept is technically valid. To do this, you need to take the most complex feature in your app and see whether it can be implemented from a technical point of view. If technical experts confirm the successful implementation of the feature, you can consider the validity of your idea proved.

Prototype. To attract startup funding companies, you need to show them what your product will look like. After confirming technical feasibility, create a prototype to demonstrate your product’s look and feel and reveal the future user experience. With the help of a prototype, you can understand how your service is used to solve specific problems and what changes should be made before starting the development phase.

Minimum viable product (MVP). Entrepreneurs who have already received pre-seed funding may look for extra resources to launch the first version of their product. The MVP contains only basic features and is needed to collect customer feedback and ensure the product is of value for users. If you see a positive trend in downloading and using the app, you can attract additional investments and move on to filling the product with more advanced features.

Attracting investors through outsourcing

Investors are looking to finance economically viable projects which will make use of a strong team. Therefore, they often investigate who will implement the project, and when, and what deadlines to expect at different stages of development. Before deciding to give money to a startup, investors will investigate how to secure funding. To guarantee that your project will be successful, you need to enlist the support of professional developers who can efficiently implement the validated idea and deliver a top-notch product on time.

Given this, outsourcing development is a wise move for startups who want to get funding but do not know how to gather a reliable development team in the shortest possible time. By partnering with remote developers, startups can avoid lengthy, tedious recruiting and make use of domain experts on-demand. If there is any doubt whether software development outsourcing is right for you, book a consultation with a company representative and discover the details of cooperation with a remote team.