Best Tech Stack for Building a Trading Platform Today

Today, you can sell and buy almost anything online. Stocks and bonds are no exception. You don’t have to go to a brokerage to make a wise investment. It is enough to download the trading app and quickly find securities at the best prices. A growing number of such services prove their value. Much talked-of Robinhood alone has 13 million users, and it is hardly the only trading platform. If you want to invest in a successful project, trading software development seems to be a great choice.

Define the requirements

Before starting any project, it is vital to agree on all the details and understand how the final product will look. Trading software tech stack will depend on the business line, target audience, running platform, and more. Let’s name essential points to consider.

App type. There are two types of trading software solutions: prop apps and commercial apps. The first option is suitable for specialized brokerage firms, while the second serves day traders and retailers. The app type determines the features to implement. For prop apps, this is usually a unique set that reflects the nature of the activity and the trading style. In commercial apps, the functions are more or less standard and cover trade placing, quote monitoring, instant payments, deposits, analytics, etc.

Infrastructure. How are you going to deploy your software? Will it be a desktop, web, or mobile solution? Should it run in the cloud or on-premise? What devices will you access it from? Decisions should be made based on the business specifics. For professional trading platforms, we suggest a web app with mobile responsiveness. Deploying it in the cloud will allow users to trade anytime, anywhere.

Unique features. Owners often opt for custom trading software because off-the-shelf tools don’t meet their needs or because they aim to occupy a unique niche in the market. If you want to make an advanced app, consider adding automation to your trading software. Also, look at the AI/ML side. Such technologies give the green light to implement robotic trading and smart advisors within the app.

Best frontend technologies to build a trading platform

When trading app developers have a clear view of the end product, they proceed to tech stack selection. The typical web-based platform consists of frontend, backend, and DevOps sides. The most popular technologies for frontend development are now React.js and Angular. Both are suitable for large-scale projects and work well for stock market software development.

Specific tech details may lean devs toward a particular direction. For example, Angular attracts with its fully-packed services. Being a mature framework, Angular offers all the components needed for frontend development. React, on the contrary, is a library. When using it, you need to involve third-party tools to implement one or another feature.

At the same time, React offers full backward compatibility. It means you can easily update and add app components as per the latest library releases. Angular apps do not work like that. You cannot jump from Angular 2 to Angular 7, for example, but have to run incremental updates. With this in mind, React seems to be more suitable if you plan to start with MVP and gradually fill it with new features.

Best backend technologies to build a trading platform

When it comes to the backend, our choice falls on Java and .NET. Both technologies are ideal for enterprise-level apps and trading platform development. They help implement complex logic and support multiple processes within the app. Java and .NET are also nearly at the same level in terms of performance and speed. That is why opting for one way, or another is only possible based on a particular project’s nature.

At Erbis, we use Java more often because it is not tied to a specific platform and has many handy tools for effortless coding. Since .NET has become an open-source recently, it has far less community and worse documentation. Yet, if you plan to build and deploy an app on Windows, .NET may be a good choice because it has a well-oiled workflow and various services for that platform.

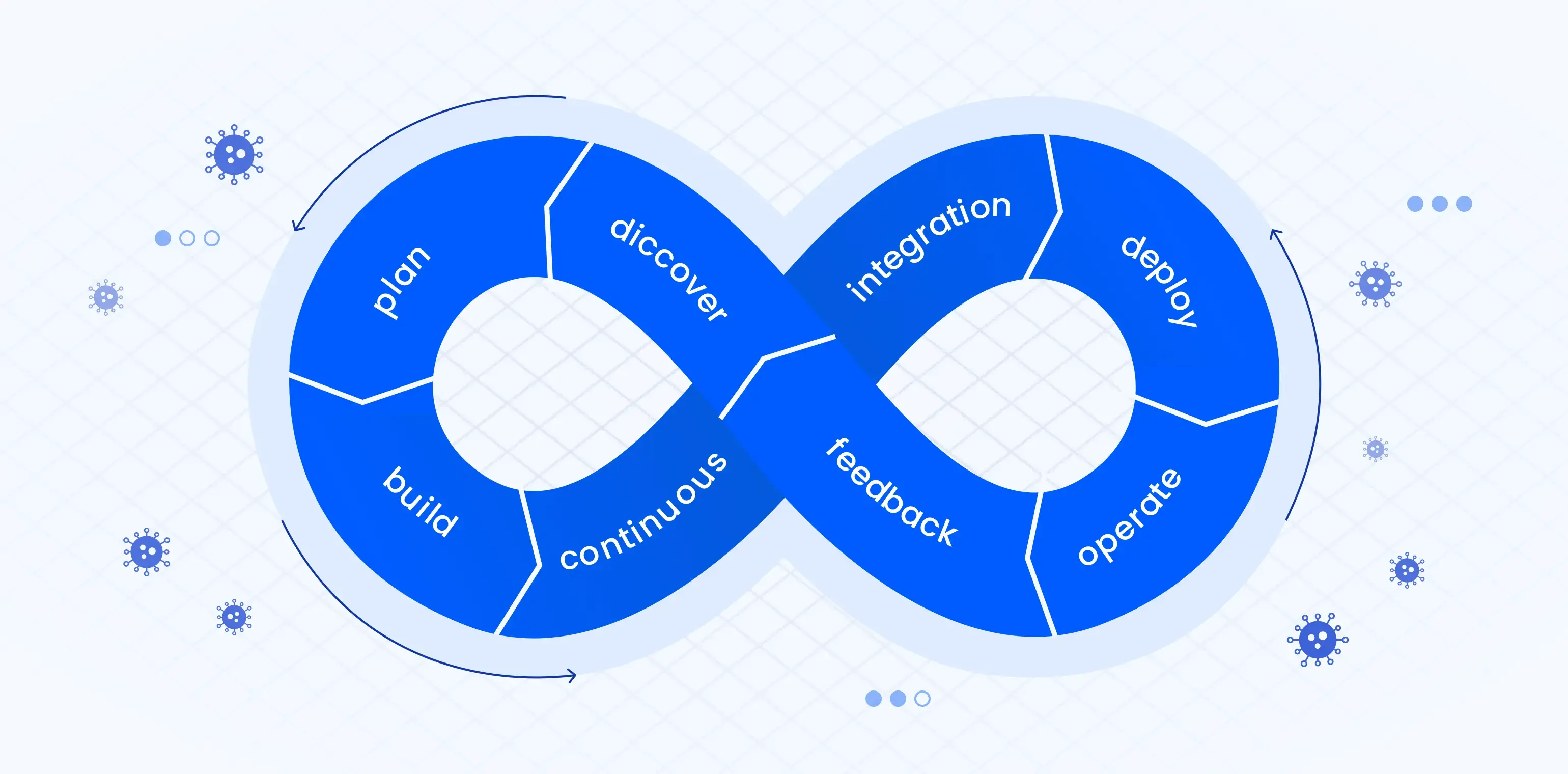

DevOps part for trading software development

DevOps role in building a trading platform lies in rapid deployment, scaling, monitoring, backing up, and porting ready app parts to other environments. DevOps tools take care of the stable work during all these operations. Jenkins and Docker are considered the most powerful ones now. Both are open-source technologies with many services and proven efficiency.

Jenkins automates a portion of the dev process without human participation. It enables continuous integration of technologies for trading into the app and maintains its stable operation. At Erbis, we regularly use Jenkins for automated deployment and managing all sorts of related tasks.

With Docker, we pack software in isolated containers and run a large number of such containers or virtual blocks on one host. This approach allows us to deploy programs in any environment: local data centers, cloud, personal computers, etc. Thus, we can quickly test and run apps with minimal resource consumption and easy scalability.

Machine learning in trading software

Smart tech is trending now and is widely used in software development. Trading apps are no exception. AI and ML turn them into powerful machines that make the right decisions and bring high profits. Unlike humans, trading bots can analyze vast amounts of data in a short time and draw emotion-free conclusions. AI technologies are one step ahead of algorithmic trading because they are not based on human inputs but make choices on their own.

Our team uses special tools and services during AI trading development. The leading one is Amazon Sagemaker. It helps create, train, and deploy ML models with no much effort. The cool thing is that all three modules – “build,” “train,” “deploy” – work autonomously with no link to each other. It means you can use them in the full cycle of ML development or for building its separate parts.

Conclusion

Trading system development is a large-scale project with complex architecture and app logic. The right tech stack largely defines its success and dev speed. In the case of a web-based app, it means choosing backend, frontend, and DevOps tools. As for the advanced features, AI and ML serve well for building smart trades and self-learning bots. If you want to develop a trading app that will stand out on the market, first should be goals and business strategy. Realizing where to go will help you pick up the means to reach the destination.